Build Capacity

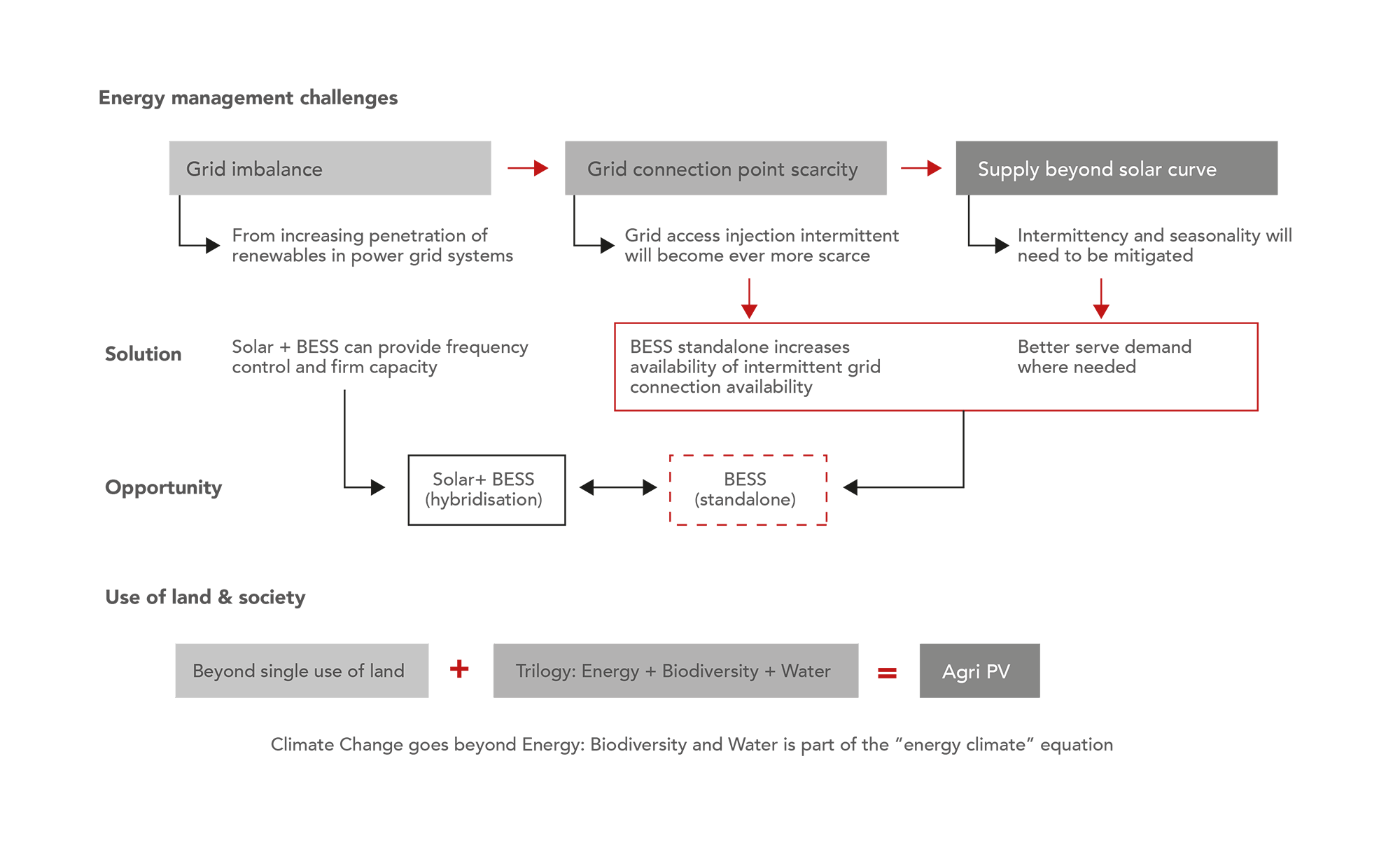

We are specifically targeting less than 50MWp projects, in the vicinity of viable load centres, with significant irradiance factors, or grid imbalance.

Sun Capital is a Solar PV and Storage development and investment partner with a strong track record in delivering value to our clients and partners. Our dynamics go further than that. We are a company built on resilience and clear line of sight. The resilience to develop and invest in highly competitive markets to become a significant player in low Solar PV LCOE and Storage LCOS, thereby assisting with the energy transition towards a low carbon footprint. The clarity in our line of sight to only develop and hold assets in unsubsidized markets, where we compete in market-based electricity segments, and where Solar PV and Storage, as a distributed generation solution, enhances grid stability and favorably competes against conventional and other renewable technologies.

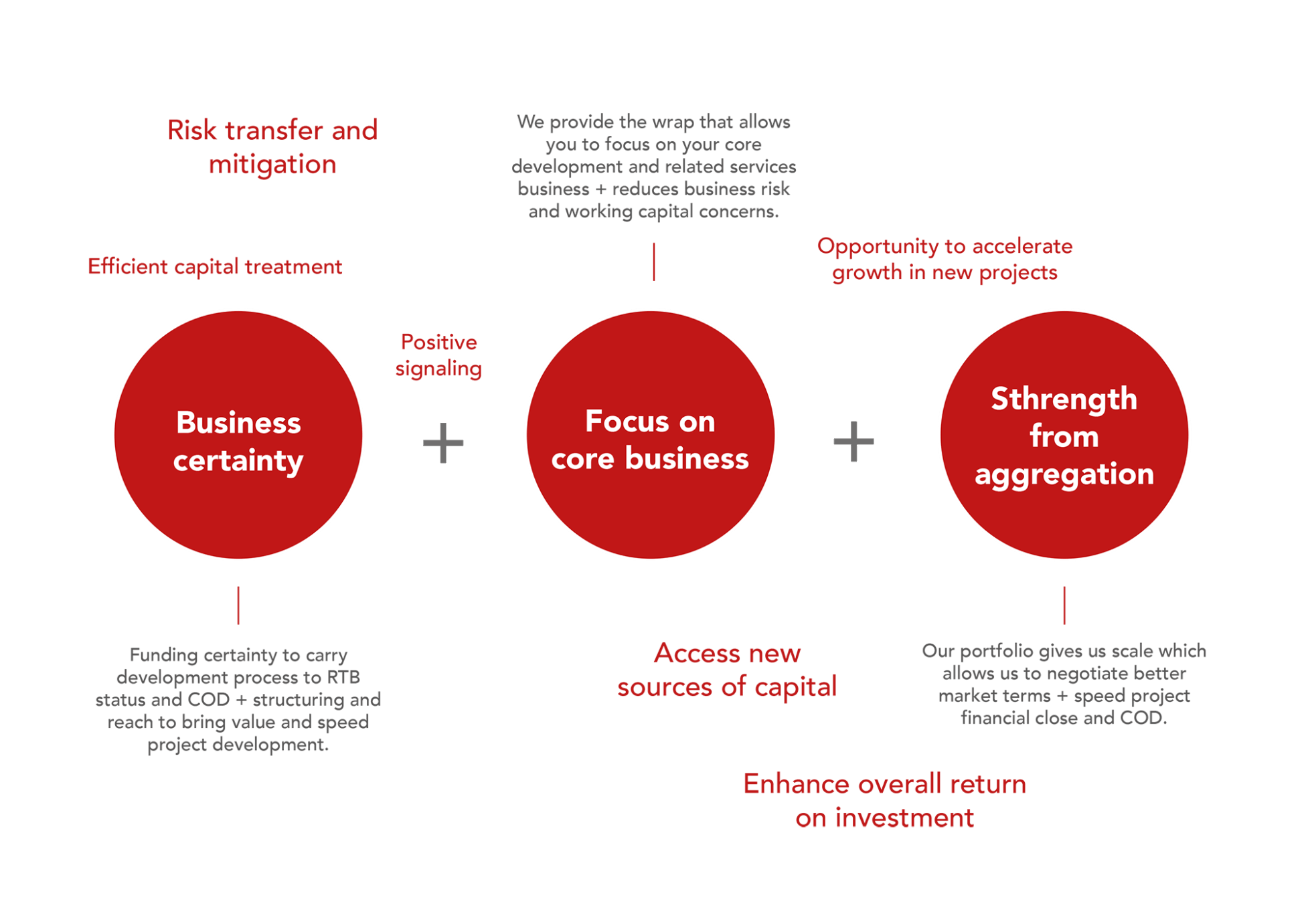

With our extensive expertise in power generation, we have the agility and knowledge to develop opportunities others find difficult to structure and execute, delivering greater value to our clients, developers, and investors.

2010 - 2016 > MATURING YEARS, Wind onshore and Solar PV projects across multiple jurisdictions and regulatory regimes, where the Sun Capital partners have delivered in excess of 4.2GWn in capacity as developer and financial advisor.

We are specifically targeting less than 50MWp projects, in the vicinity of viable load centres, with significant irradiance factors, or grid imbalance.

We either develop on a stand alone basis or create development partnerships with local developers, as we believe this is where significant dislocations prevail and give rise to momentous efficiency gains.

We deliver measurable impact towards the EU’s energy transition, and our clients and partners. We strongly believe that our development and structuring track record accelerates projects development cycles, and provides an attractive investment yield to our clients.

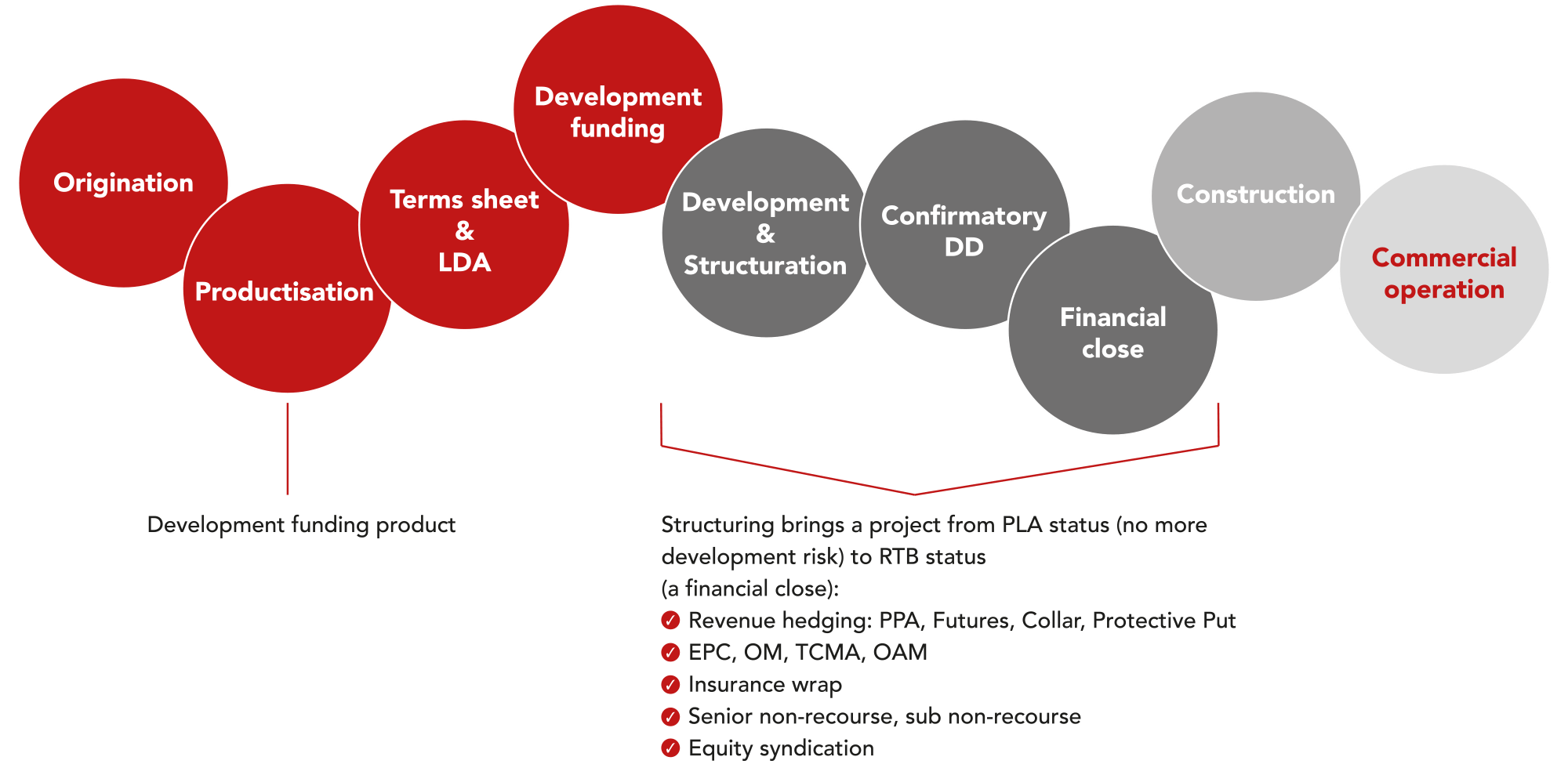

We create the development funding product and raise the funding requirements through our regulated placement network.

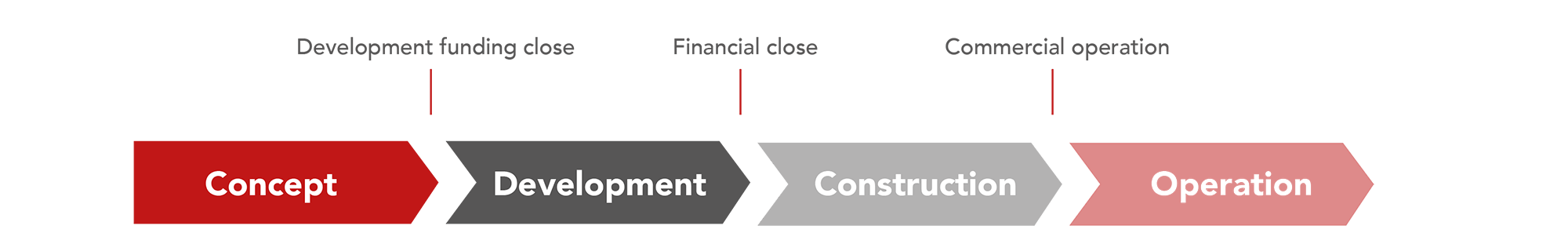

Whether we act as development partner or develop on a stand alone basis, we take ownership of the entire process from funding close to financial close, covering both development and structuring activities.

We invest alongside our clients, with an equity share that will range from up to 70% to a minimum of 10%. Being in a competitive market, we typically provide revenue management services to our investee OpCo SPVs.

Our passion is dedicated towards developing and financing projects in countries where Solar PV and Storage constitutes an economically viable response to growing energy needs. By focusing on geographies where grid solutions are required for frequency and voltage, and where solar resources are of high quality, we demonstrate our creativity and flexibility to adapt our solutions and optimize the cost of produced electricity.

More than 18 years of experience in infrastructure, project finance and alternative investments, mainly in the energy transition sector. Prior to co-founding Sun Capital Development Partners, I was leading project finance and energy transition at Duff & Phelps and held executive roles in renewable power generation companies. Within the renewable power generation segment, I have developed, financed, and sold in excess of 1GW in Solar PV, small Hydro, and Wind onshore capacity. I currently share the direction of Sun Capital Development Partners with my position as Senior Director at Finenza, a boutique advisory firm with a significant track record in fund placement and impact driven real asset advisory. I have a PP&E from Oxford University and an MBA from London Business School.

Environmental Engineer with a strong interest and expertise in Sustainability and Green Solutions. I have a Degree in Civil and Environmental Engineering and obtained a Master's Degree in Protection and restoration of the environment. I love investing my time and energy in sustainable businesses and technologies that have a positive impact on people, environment, and economy. With experience in the construction of photovoltaic plants in Southern Euro area, I am part of the Sun Capital Development Partners team as Project Manager.

During my degree in Mechanical Engineering, I had the opportunity to attend the Solar Energy Institute of Madrid where I was able to learn about the progress and growing interest in photovoltaics. Since then, my connection to photovoltaics has not stopped. I studied a Master in Renewable Energies and Environment, and I have worked since then in companies involved in different aspects of the photovoltaics projects: a tracker manufacturer, a developer and now, for more than a year in Sun Capital Development Partners where I head the company’s operations.

Graduate in Accounting and Finance. I started as an administrative accountant in a consultancy where I was in charge of the accounting of different companies, as well as their management. Subsequently I have worked in an additive company for engine maintenance in the administration department. Since mid-2021 I am working at Sun Capital Development Partners where I care for the all the companies treasury, control, accounting and administration.

Graduated in Business Administration and Management in Segovia, specializing in banking, finance, I started working in consultancies and advisory firms, followed by companies in the sales, recycling and construction sectors. I have worked in the areas of communication, accounting, and sales. Now, I am part of the Sun Capital Development Partners team as an accountant and administrator. There is no doubt that the renewable energy sector is essential for a balanced and sustainable future.

Graduate in law by the University of Valencia with an LLM in Commercial and Corporate Law from Queen Mary University of London and a Master in Legal Practice from CEU San Pablo University.

I gained my first professional experience in the commercial law and energy law department of a prestigious Spanish law firm, by providing legal advice in company law matters and the development of solar projects from both corporate and public law perspective. My main areas of practice are energy law and corporate law, specializing in the development of renewable energy projects.

Graduated in Finance and Accounting from the University of Valencia. After finishing my degree I started in banking where I carried out tasks related to administration and accounting. Also, I have experience in the industrial sector. Attracted by the world of renewable energies, I started in Sun Capital Development Partners giving support in the accounting department. My great interest in the company operations leads me to want to expand my knowledge; as an example of this nowadays, I support the technical area in the search for land opportunities.

Entrepreneur, Cybersecurity and Cyberintelligence evangelist for the last twenty years, strategic and long-range planning, advisor, writer, speaker , think –tanks collaborator, owner & founder telco and security companies and business schools for the last thirty years.

One of my goals will be reedit the Spirit of the Toledo School of Translators, cradle of dialogue between the three communities: Christian, Jewish and Muslim. Retrieving the project conceived by King Alfonso V in 1085 AD, in Toledo, the city became an important centre of cultural exchange and peaceful coexistence.

Spain is an intercultural hub and one of our assets is to be one space of collaboration. It´s our Brand Spain.

My main job and privilege is to build Bridges between people based on understanding and respect for all human beings, using the available technologies to build those bridges, but always having the opportunity to talk face to face all those whose lives he touches. Since 1985 I have been working in behavioural models of individual behaviour to understand and explain the social mindset using Technology as a social transformation driver.

Francisco has more than 20 years of experience in asset management and investment advice. He was director of Credit Suisse Private Banking Madrid and CEO of Afina-Commerzbank. In 2006 he founded Finenza, an independent boutique specialising in capital raising and investment banking.

Finenza is an independent investment banking boutique.

Our specialization is capital raising, fund raising, new partners and investors.

We promote asset managers and investment products, exclusively oriented to institutional clients.

We develop marketing plans for our associated managers and act as their partner in marketing their products.

Finenza is also a consultant on alternative investment and specific assets, particularly on Microfinance, in which Finenza has become one of the leading specialists.

Finenza currently has six offices and is registered by the AMF, the French regulator.

I have been part of the financial industry in various management positions and as a management consultant since the early 1990ies. I have worked in most functions within asset management organisations, ranging from portfolio management, over operations to business development. I have worked with real assets, cleantech, private equity, venture capital and more traditional asset classes.

I have been involved in start-ups with a European focus both as a founder and as an employee. Most of these start-ups have been within the asset management industry, but I have also worked with completely different industries like e.g. agricultural infrastructure. My core competency is building and growing a new business or business line.

In 2022 I co-founded the Altinium Development platform in cooperation with Sun Capital Development partners. The Altinium Development platform institutionalises Sun Capital’s development process of Solar PV and BESS assets in Southern Europe.

Chroma Impact Investment is a catalyst in energy transition. Their current geographic focus is Europe and Africa, and their shareholders come from Belgian industrial families who want to participate in the energy transition, while contributing concretely to the development of meaningful projects with a positive social and environmental impact. Chroma invests in grid-connect solar plants as in greentech and social impact energy ventures.

contact@suncap.eu

Maria de Molina 5, 2 izquierda

28006 Madrid, Spain.